It can take 18 to 30 months for freight rates to drop back to normal - Sea-Intelligence

Sea-Intelligence analyzed the composite China Containerized Freight Index (CCFI) to see how long it will take for freight rates to return to normal.

Container freight rates have risen to record highs for a long time

Sea-Intelligence, a Danish company providing research & analysis, data and consulting services in the global supply chain industry, Sea-Intelligence analyzed the composite China Containerized Freight Index (CCFI) to see how quickly freight rates can return to normal, using historical data for analysis.

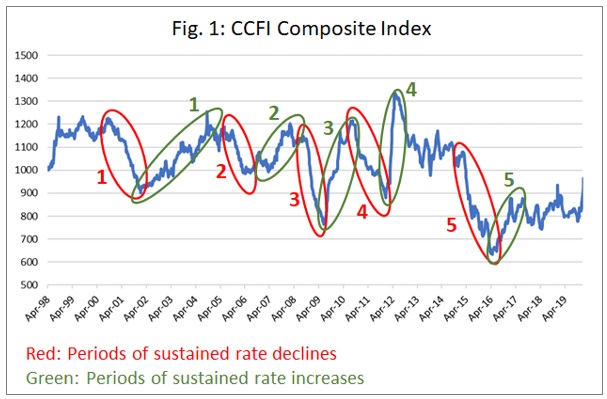

In the following figure, Sea-Intelligence has narrowed down the pre-pandemic CCFI data and identified five periods of rate reductions (highlighted in red), as well as five periods of rate increases (marked in green).

Source: Sea-Intelligence.com, Sunday Spotlight, issue 540

Based on this, Sea-Intelligence analysts identified periods of rise and fall, and analyzed each time period separately.

"We measured the rate of decline in terms of the average percentage point drop per week, over the full period of each of the 5 decline periods. This ranged between -0.4% and -0.9% per week. If these time periods are to reflect the inherent pricing mechanisms in the industry, we can use them to calculate a reversal back to normality," said Alan Murphy, CEO of Sea-Intelligence explains.

However, this raises the next question: what is the normal rate level? Based on past CCFI data, this is represented by rate levels around the 1000 index level.

Sea-Intelligence points out: “This represents a decline of -69% from the current rate level".

During the global financial crisis of 2008-2009, rates fell at the fastest rate of -0.9% weekly, and if we apply this rate of decline to current rates, it will take 18 months to return to "normal", according to the analysis.

However, if the decline in rates matches the average seen over the five periods of tariff declines, normalization would take at most 26 months. However, it can be argued that the current gain is much stronger than in the past, and that should be taken into account.

“To do this, we calculated the average weekly rate increases for the five periods with rate increases,” says Murphy.

On average, over the five reduction periods, freight rates fell by an average of -0.6 percentage points per week, while in the five increase periods we saw a 1.1 percentage point increase in freight rates over the same period.

This shows a coefficient of 1.8 between gains and losses, which means that price increases tend to be 80% stronger than declines, on weekly basis. When current rates emerge after a 17-month period of continuous price increases, it will take 30 months to return to the 1000 index.

See more:

- Container freight rates on the transpacific route have fallen by 50% since September

- Global supply chain disruption expected through 2022

- Profit forecast of container shipping lines is up to 150 billion USD in 2021 and possibly more next year

- Freight rates will begin to stabilize in mid-2022 - Aurelio Martínez, President of PAV

Source: Phaata.com (According to ContainerNews)

Phaata.com - Vietnam's First Global Logistics Marketplace

► Connect Shippers & Logistics companies faster

.png)

.jpg)