Container spot rates are lower than long-term rates on the trans-Pacific route

Container spot freight rates from Asia to the US West Coast have fallen below long-term contract rates, prompting many shippers to start reviewing their contracts with shipping lines.

Spot container rates are lower than long-term rates on Asia-North America route

Container shipping on the trans-Pacific route from Asia to the US West Coast has come at a critical juncture with spot rates falling below long-term contract rates, prompting many shippers to start review their contracts signed with shipping lines.

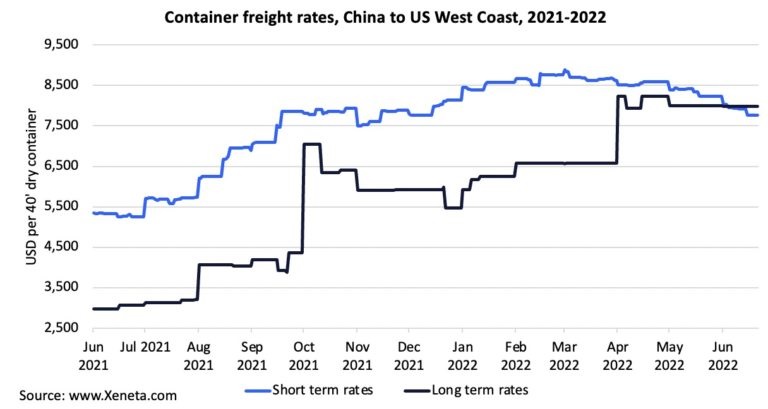

Data from Oslo-based Xeneta platform shows that short-term rates are currently 2.7% lower than signed contracts, with spot rates at $7,768/FEU and long-term rates at around $7,981/FEU which has skyrocketed 159.9% over the same period last year.

Peter Sand, head of analytics at Xeneta, said: “What we’ve seen over the last year is strong growth for both sets of rates, but really spectacular gains for contracted agreements." “That has led the gap between the two to diminish and, with supply chains bursting at the seams and shippers looking to manage risk as much as possible, the demand for spot deals has fallen slightly on this trade, bringing prices down. This creates opportunity for those with limber logistics strategies."

Container freight rates from China to US West Coast (Source: Xeneta)

The rapid narrowing of the gap between spot and contract rates on the trans-Pacific trade, from Asia to the West Coast of the United States, has surprised many shippers, the gap has peaked at $4,000 in September of last year.

Meanwhile, a survey of small and medium-sized importers on the Freightos platform revealed recent reports of growing retail inventories and falling demand.

More than half of respondents said they had ordered early during peak season in the hope of securing a spot.

Two-thirds said they were experiencing a drop in demand, with 84% attributed to inflation.

According to Freightos, congestion continues to ease at Los Angeles and Long Beach, the two main ports on the US West Coast, with ocean freight times from China to the US down 25% since the start of the year, and by with a year ago, according to Freightos.

"There were more signs this week of inventory surpluses and a resulting slowing in orders by major retailers suggesting a decrease in demand – at least for certain goods – as consumers shift spending to services or to the inflated costs of necessities, or both," commented Judah Levine, head of research at Freightos. Judah Levine also pointed out that there are very few congested ports in Shanghai, which shows no sign of the pent-up demand that many expect to increase once the city reopens.

With long-term rates and spot rates heading in different directions, Levine points out: “Ocean contracts are notorious for not being honoured during market swings.”

Major retailers such as Walmart, Target, and Amazon have recently pointed out that recent overstocking may lead them to cut back on imports to improve inventory turnaround times.

“Consumer retail expenditure seems to be at a tipping point, inevitably reducing total volumes getting ashore. We expect this to push prices further down in the future,” said Shabsie Levy, CEO and founder of Shifl.

Levy believes that long-term ocean freight rates are higher than spot ocean freight rates, this situation may not last.

“When shippers realise spot prices continue to cascade, they could look to renegotiate their contracts with container lines,” Levy said, echoing Levine's comments at Freightos.

Samsung, the seventh-largest importer to the US, halved its planned orders for July. The United States' second-largest importer, Target, has announced its intention to cut its orders because of high inventories.

“Our data indicates that the hike in interest rates by the Fed is another blow to consumerism, as other industries, including services and real estate, see a hit in fortunes. Mortgage rates going up significantly from last year can result in slowing house construction starts, further reducing related retail spending,” Levy said.

Read more:

Source: Phaata.com (According to Spash247)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.png)

.jpg)