Shipping demand hasn't exploded globally, so why are freight rates so high?

Maersk's freight rates in the second quarter increased by 63% compared to pre-COVID, while global shipping demand increased by only 3%.

Maersk's freight rates in the second quarter increased by 63% compared to pre-COVID (Image: AFP via Getty Images)

There has been no strong growth in global shipping demand during COVID. Although there is a temporary spike in congestion combined with a boom in local demand based on savings and stimulus in the US.

That's the explanation for the soaring freight rates that gained more attention on Friday when shipping giant Maersk released details of its quarterly results.

Maersk - which provisionally reported record Q2 2021 results last Monday - estimated that global container shipping demand grew only 2.7% in the second quarter compared with the same period two years ago, when before the pandemic.

And yet, Maersk's average freight rate (including short-term and long-term contract prices) was $3,038/FEU, up 63% from $1,868/FEU in Q2 2019. Price index Drewry World spot rates rose to $9,371/FEU last week, 6.7 times higher than two years ago.

Consultant Lars Jensen - CEO of Vespucci Maritime - told American Shipper, “Global demand for the first part of the year is up around 4% compared to 2019. We did not have a capacity problem in 2019. We had enough ships, we had enough containers, ports were fine, and trucks and rail were fine, at least from a global perspective."

"With global demand growth of 4% since then, we shouldn't have the problem we have now. You have some bias due to the boom in demand in North America, but that is by no means due to the boom in global demand - because that does not exist. The main problem right now is transport capacity".

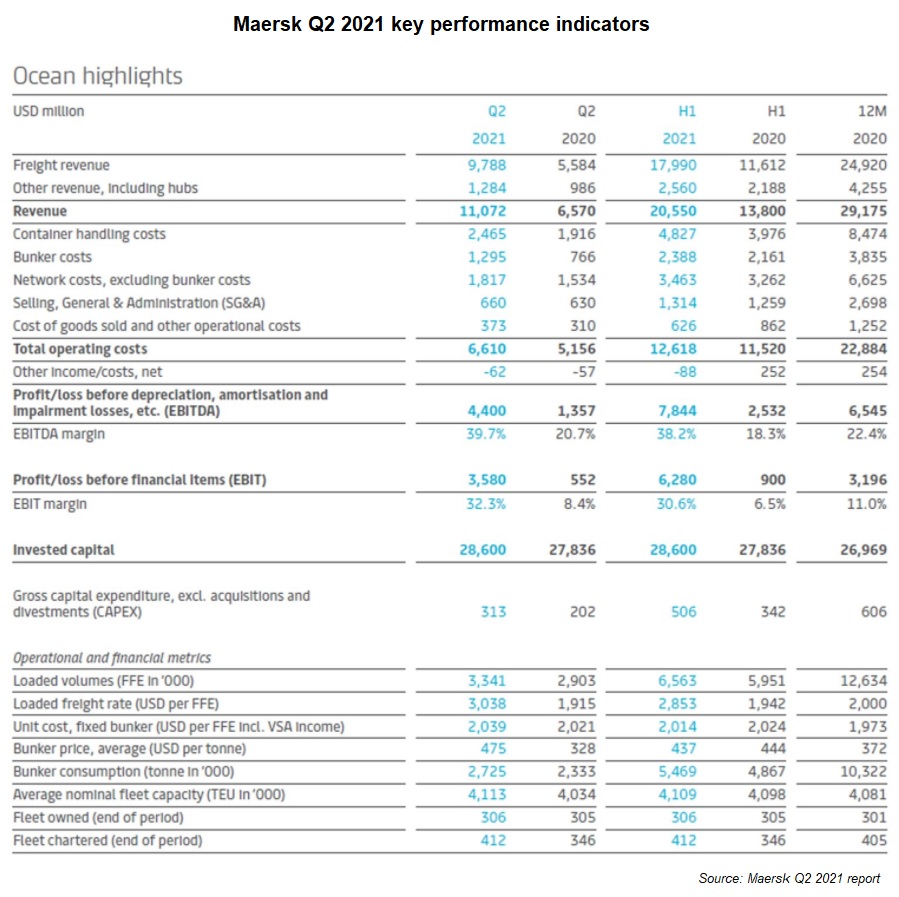

Maersk Q2 2021 performance report

Congestion affects transport capacity

Sea freight capacity is severely limited due to congestion, with equipment scarce both on land and at sea.

Maersk sent out a recommendation to customers last Wednesday with the headline, "Critical help needed — congestion increasing." Maersk urged US customers to return equipment more quickly, stating: “We do not anticipate the congestion decreasing any time soon. On the contrary, the industry overall is forecasting higher [U.S.] volumes into early 2022 and beyond."

Alphaliner reported this week: “Carriers need much more tonnage as ships get stuck in congested ports in both the U.S. and Asia. Some carriers reported that they needed at least 20-25% more fleet capacity [in the trans-Pacific] to continue carrying the same amount of cargo.”

Maersk confirmed that its own fleet capacity has fallen from pre-pandemic levels due to congestion.

Vincent Clerc, executive vice president of Maersk, said in a phone call last Friday: “Our fleet has grown by 2% from 2019 but our volumes are down by 3%. It basically takes more TEUs [twenty-foot units of fleet capacity] to transport each FFE [forty-foot boxload of cargo]. That will go away when congestion goes away.”

Too many affecting issues happen continuously

“The U.S. is booming enormously,” explains Jensen. “And while you can certainly shift vessels and containers from one trade to another, you cannot shift ports from one trade to another. It also doesn’t do you any good to have plenty of trucks in another country if the trucks are needed in the U.S. The same with rail."

Capacity problems and driver shortages are a constant occurrence - "one domino after the other" - from mooring conditions off the coast of California to the congestion of the Suez Canal to closures at the port of Yantian, China. The next imminent threat is an outbreak of the Delta variant in China, Jensen continued.

“You always have some vessel breaking down somewhere. Normally if that happens, you charter a replacement vessel or shift the cargo to another service. But now, there are no vessels left to charter and shifting the cargo to another service is out of the question. They’re already all booked. So, every tiny operational mishap adds more cargo to the pile of cargo you can’t move. And things are just getting worse.”

Everything we see now is only temporary

When the congestion finally clears, which is more likely to be the 2022 event, short-term rates could quickly fall back from extreme highs if capacity is delivered more efficiently amid global demand growth is outstanding.

“We need to bear in mind, given the extreme levels that we see on the short-term rates, that the correction towards a more normal level could be quite rapid,” Clerc said.

Jensen said, “I believe everything we see now is temporary. It’s all governed by COVID and eventually it’s going to go away. I don’t see COVID changing anything structurally. So, for me, what’s interesting is the underlying trajectory of the industry prior to the pandemic."

That trajectory, he said, is one of the fundamentals that gradually improves for carriers, better capacity management due to consolidation between carriers and higher rates.

Once congestion eases and capacity returns to the market, Jensen predicts that “freight rates will drop significantly from where they are today, but it won't go back to where it was before the pandemic. It's definitely going to be down from where it is now, but it's still going to be a significant increase from where it was."

Read more:

- Maersk reports record business results for Q2 and expects Q3 to be even better

- Container shipping rates continue to rise

- Congestion begins to increase again at US West Coast ports

Source: Phaata.com (According to FreightWaves)

Phaata.com - The first international logistics marketplace in Vietnam

► Where Shippers & Forwarders connect fast!

.png)

.jpg)