Maersk profits $30.9 billion in 2022, expects to drop at least 84% in 2023

AP Moller – Maersk reports best-ever profit of $30.9 billion for 2022, but is expected to earn less than a fifth of that figure in 2023 as the container shipping market declines.

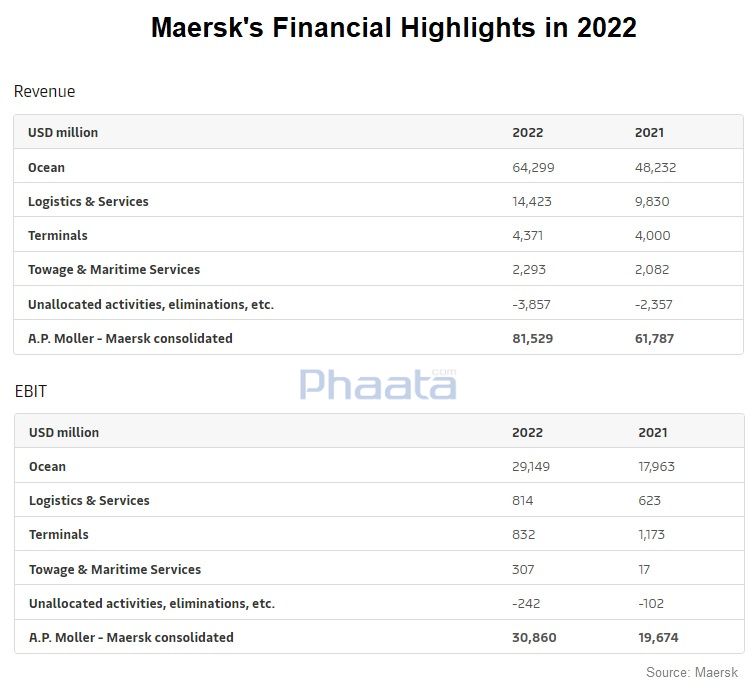

Maersk reported consolidated EBIT of $30.86 billion in 2022, up from $19.74 billion in 2021. 2022 revenue grew 32% at $81.5 billion versus $61.79 billion a previous year.

“2022 was remarkable in more than one way. While we report the best financial result in the history of the company, we have also taken the partnerships with our customers to a new level by supporting their supply chains end to end during highly disruptive times,” commented Vincent Clerc, CEO of AP Moller–Maersk.

The stellar results won't last, however, as Q4 2022 earnings decline year-over-year, leading to a much larger-than-expected decline in 2023. Maersk noted that "expected normalisation" has begun for Maersk's shipping (container shipping) business by the end of the year.

In Q4 2022, Maersk reported a $1.5 billion drop in EBIT to $5.1 billion from $6.5 billion in the same period a year earlier.

The drop in Q4 profit was attributed to the container shipping business with an EBIT of $4.8 billion in Q4 2022 compared with $6.3 billion in Q4 2021. Maersk attributed the drop to “Driven by lower volumes and lower freight rates on shipment rates on routes from Asia to Europe and to North America together with higher costs related to bunker, container handling and network.”

Maersk's financial highlights in 2022

Maersk's forecast for 2023 and full-year target at the top of its range is lower than its profitability in Q4 2022 alone. The Danish company is setting a full-year target for EBIT of $2 billion - $5 billion.

“Guidance for 2023 is based on the expectation that inventory correction will be complete by the end of the first half leading to a more balanced demand environment. 2023 global GDP growth is expected to be muted and global ocean container market growth to be in a range of -2.5% to +0.5%," said Maersk. Maersk added that they expect the growth rate to be in line with the market.

Looking at its container shipping business in 2022, Maersk said it "continued to deliver on the strategic transformation, maintaining a stable level of long-term contracts". Maersk's annual report shows a slight decrease in the proportion of shipments booked at long-term contract rates to spot rates, from 71% in 2021 to 70% in 2022.

Some market watchers say that as spot rates have plummeted, shippers can increase the proportion of shipments ordered by spot rates rising higher in anticipation of a further drop in spot rates.

Maersk's future strategy is based on growing its logistics and services business to become an integrated logistics service provider, and the company has made a number of acquisitions related to logistics. Famous needs include LF Logistics and Senator. The acquisition of LF Logistics added approximately 3.1 million square meters of warehouse space across 198 facilities, and Maersk's overall warehousing capacity has more than doubled to 7.1 square meters.

Speaking at a press conference in Singapore this week, Ditlev Blicher, Maersk Asia Pacific President, said they are about 40% complete on their journey to becoming an integrated logistics service provider, co “We’re still building capability.”

Despite an impressive 47% revenue growth for its logistics and services business to $14.4 billion in 2022, the sector still accounted for only 17.7% of Maersk's total revenue last year. Organic growth from logistics is 21%, which the company says comes mainly from its top 200 customers.

CEO Maersk Clerc said: “As we enter a year with challenging macro-outlook and new types of uncertainties for our customers, we are determined to speed up our business transformation and increase our operational excellence to seize the unique opportunities in front of us.”

Read more:

- Maersk and MSC to end 2M Alliance in 2025

- Excess capacity could cause a new price war among container lines, warns Evergreen chairman

Source: Phaata.com (According to Maersk | SeatradeMaritimes)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.png)

.jpg)