Demand for durable goods plummets in the US

According to Sea-Intelligence, spending on durable goods in the United States is falling sharply and gradually approaching pre-pandemic levels.

Some durable goods (Image: Getty Images)

With spot rates plummeting on most major shipping routes in recent times, market participants are anxiously assessing whether this means this year's peak season is weaker than record-breaking peak seasons in the past two years.

The global freight rate records were driven by a shortage of vessel capacity. Before the new ships are scheduled to be delivered in 2023, adding capacity to the market, so the drop in spot rates stemming from US import demand has eased.

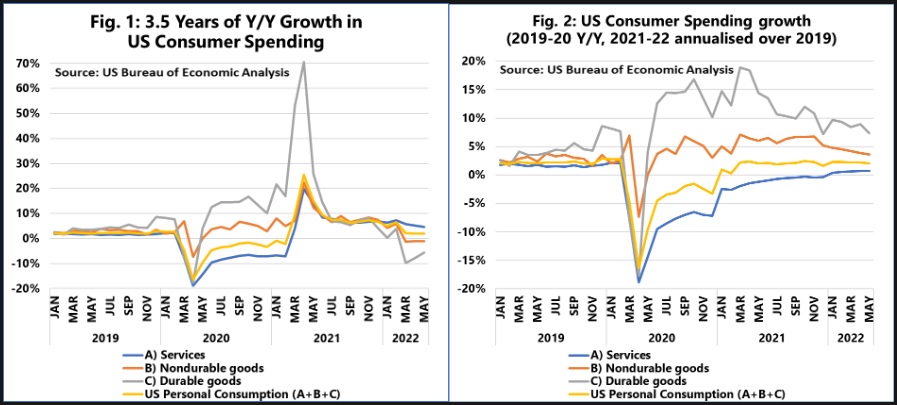

In the Sunday Spotlight issue 572, Sea-Intelligence analyzed the latest US Consumer Spending data released by the US Bureau of Economic Analysis (BEA). Figure 1 shows the growth in US consumer spending over the past three and a half years. In Figure 2, which shows the year-over-year growth in US consumer spending over 2019. There are two main takeaways from this analysis.

Consumer spending growth in the US (Image: Sea-Intelligence)

Firstly, although the growth in 2021 is severely affected by the sharp decline in 2020, it is clear that there is very good growth for durable goods in 2021, far exceeding any level seen in the past 20 years.

Second, US consumer demand is in a strong downward trend for durable goods.

Sea-Intelligence has concluded that spending on durable goods is gradually approaching pre-pandemic levels.

While there is no definite answer on the strength of the peak season, Sea-Intelligence commented: "very clearly that the unprecedented strength of the Durable Goods consumption has slowed down in recent months. We are not seeing a boom or a crash in the market, but rather one that looks headed for a gradual return to the slower pre-pandemic levels."

Read more:

- Post-Covid demand boom for container shipping coming to an end

- Container shipping lines blank sailings to cope with falling demand

Source: Phaata.com (According to Sea-Intelligence)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.png)

.jpg)