Air freight demand decreased in March but freight rates remained high

Air freight volumes in March fell year-on-year as the market was affected by the war in Ukraine, sanctions and lockdowns in China.

Demand for air freight fell in March, but freight rates remained high (Photo: Freepik)

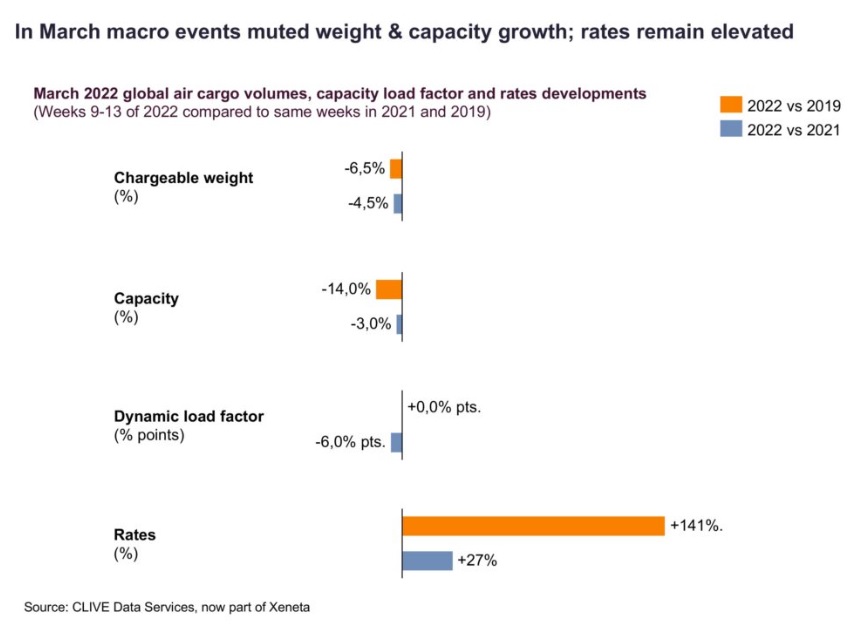

Latest figures from CLIVE Data Services, a division of Xeneta, show demand in March fell 4.5% year-on-year - and down 6.5% from pre-Covid 2019 levels - marks “sudden interruption to the recovery trend of recent months after the peak Covid disruption of the past two years”.

Capacity in March fell by 3% year-on-year and 14% year-over-year.

As a result, the load factor - taking into account both weight and mass - stands at 66%, the same level recorded in 2019 and six percentage points lower than in 2021 after hitting a record that year.

Compare air freight rates and volume in March 2022 with 2021 and 2019 (Source: Xeneta)

Although planes were less fully stocked in March than they were a year ago, actual prices were up 27% year-over-year and 141% higher than two years ago.

This could lead to disruption on the ground, said Niall van de Wouw, director of air transport at Xeneta.

“There are also still many issues with capacity on the ground. One bottleneck got replaced with another one," Van de Wouw said.

“Load factors are lower this year than they were last year, but prices are higher. The latest disruption in Shanghai is not unexpected but it adds to the worldwide issue of staff absence because of high Covid cases."

“Pilots, cargo handling workers, truck drivers etc, unlike many others, cannot work from home. It’s hardly surprising then to hear the International Monetary Fund (IMF) blaming soaring shipping costs for driving up inflation rates."

“Right now, the airfreight and oceanfreight markets are in general a mess, with shippers and consumers having to pay the price. In the first two months of 2022, we were talking of growing resilience in the airfreight market and a recovery to pre-Covid levels. March data shows how quickly this can change.”

CLIVE also noted an increase in capacity in the spot market on certain shipping routes, such as the Europe-Japan route, where the charge weight calculated on the spot rate increased by 60%. market, or 20 percentage points higher than February's spot market share.

Air freight rates from Japan to Europe rose to around €5/kg, almost 50% higher than in the weeks before the Ukraine war.

Carriers on this route have reduced capacity as they seek routes that avoid Russian airspace.

“In overall air cargo market terms, March was a step back from the trend we saw late last year and earlier this year. We have been reminded of how the limited control the general airfreight market has over its own destiny and how it is impacted by passenger traffic trends, disruption in the ocean freight market, and geopolitical events,” said van de Wouw.

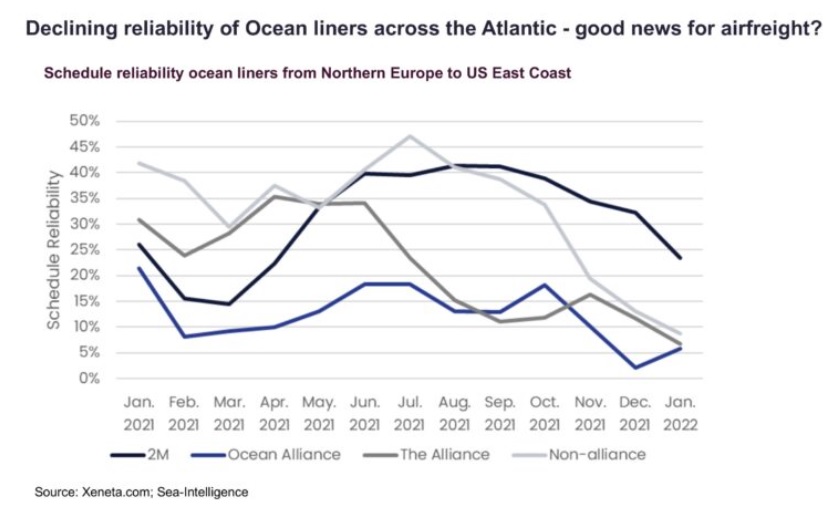

He added that continued disruptions in ocean freight could boost demand for air cargo while higher inflation could have negative effects.

"Although it is too soon to tell what the skyrocketing inflation numbers in the US will result to, the logistical difficulties on the water between these two continents must put some wind into the sails of the air cargo market."

“With continuously declining schedule reliability of the ocean liners, logistical departments will likely be required to resort to airfreight because of disruptions to their supply chains caused by these record low service levels,” he said.

Reliability of shipping schedule sharply decreased (Source: Xeneta; Sea-Intelligence)

Read more:

- Air freight rates remain high as many challenges

- FedEx forecasts air freight capacity will continue to short in 2022

- Air freight rates hit record highs

- Air freight rates skyrocketed due to the difficulties of sea freight

Source: Phaata.com (According to AirCargoNews)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.png)

.jpg)